Two-thirds of firms surveyed are completely operational

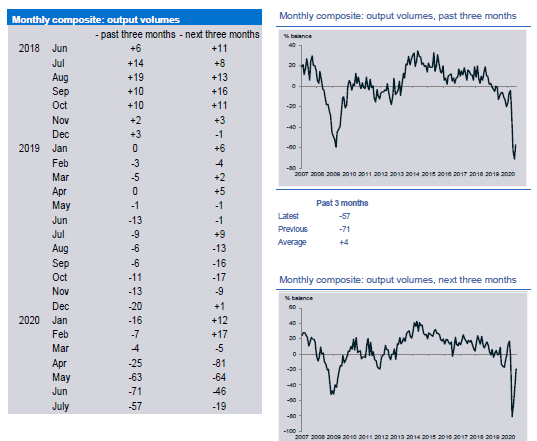

Private activity fell sharply in the three months to July, but at a slower pace than last month (-57% from -71%). That’s according to the CBI’s monthly Growth Indicator.

The composite measure, based on 752 respondents (between 25 June and 15 July 2020), saw business and professional services activity (-50% in July from -77% in June) and distribution sales decline at a slower pace than last month (-47% from -57%). Manufacturing output (-59% from -57%) and consumer services activity (-88% from -89%) continued to fall at broadly similar rates.

Looking ahead, the pace of decline is expected to ease further over the next three months (-19%). Manufacturers expect output to grow (+15%), marking the first time that expectations have been positive since lockdown measures were introduced. Distribution (-16%), consumer services (-49%) and business & professional services (-23%) expect activity to fall at a slower rate.

Supplementary COVID survey questions revealed:

- Only 6% of firms remain non-operational (down slightly from 9% in June), whilst 21% are partially operational (from 35%). Around two-thirds of firms (67%) are completely operational (i.e. with all sites open, or some operations/staff offsite).

- A one-metre social distancing rule on average allows firms to operate at 85% capacity, compared to 72% under a two-metre rule.

- The proportion of firms citing low demand as an operational challenge remained high (68%) but eased slightly from June (74%).

Alpesh Paleja, CBI Lead Economist, said:

“With businesses gradually reopening, this month’s data seems to indicate a turning point for the economy. Yet activity is still falling sharply, particularly for those in consumer-facing sectors.

“It’s clear that many businesses remain in acute financial distress. The Chancellor’s Summer Statement was a good start in addressing the growing economic legacies of COVID, but there’s more to do. More immediate direct support for firms, from grants to further business rates relief, is still urgently needed.”

Supplementary COVID-19 specific questions:

- Perceived challenges related to workforce absences have subsided somewhat, with fewer firms concerned about absences from school closures (22% from 37%), transport difficulties (9% from 23%) and illness (9% from 15%).

- 37% of firms are conducting, or planning to conduct, conversations with landlords/managing agents to review office space requirements because of increased levels of remote working.

- 26% of firms now see half or less of their office space as essential. 65% of firms see at least 20% of their office space as non-essential.